Change to the chain?

On the verge of a new market cycle.

According to a report by Statista, the estimated market size of long-distance freight trucking market in Canada was $26.5 billion USD in 2021. However, the Canadian freight spot market weakened in April 2023 with more trucks and fewer loads. The US freight market supply and demand undercurrents are showing signs suggesting demand fundamentals are improving and capacity is starting to tighten. Could this be the bottom of the freight cycle?

The market freight cycle is about supply and demand in the truckload market. The truckload market moves in a recurring cycle, going from equilibrium (where shipper demand and carrier supply are balanced) to inflation (more freight than trucks) to deflation (more trucks than freight) and back to equilibrium. A full market cycle typically lasts around 10-12 quarters (two to three years).

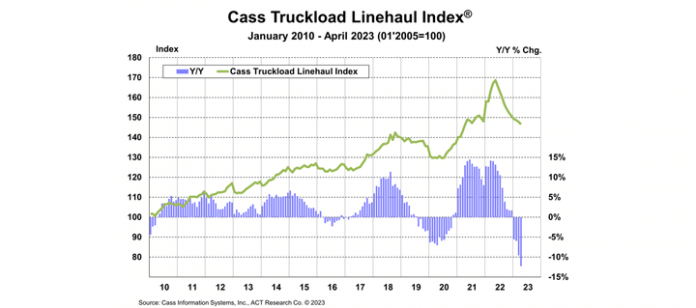

Tim Denoyer, ACT Research’s vice president and senior analyst, said this about the Cass

Transportation Index Report April 2023. “After a long soft patch, we see the U.S. freight

transportation industry on the verge of a new cycle as we begin to transition from the bottoming phase into the early phase of the freight cycle in the months to come.” The freight cycle remains weak and spot rates might be at their lowest.

DAT Freight & Analytics reports fleet freight volumes dropped and national average spot rates for dry van and refrigerated loads fell for the fourth consecutive month in April.

- Vans down 15.5% from March – 12.3% lower year over year

- Reefers fell to 154 (-16.3%) from March – 12.5% lower year over year

- Flatbeds was -13.7% lower compared to March – 3.5% higher year over year

The US national average load-to-truck ratios decreased indicating weaker demand for truckload

capacity on the spot market.

- Van ratio: 1.9, down from 2.0 in March, and 3.4 in April 2022.

- Reefer ratio: 2.7, down from 3.0 in March and 6.3 year over year.

- Flatbed ratio: 12.1, down from 12.1 in March and 64.5 year over year.

Lower demand for truckload services led to a drop in US national average spot van and reefer rates: Spot van rates averaged $2.06 per mile, down 10 cents compared to March and 71 cents lower year over year.

- spot reefer rate -0.9 cents to $2.41 per mile, 72 cents lower from April 2022.

- spot flatbed rate -0.4 cents to $2.67 per mile, down 70 cents from 2022.

Warm spring weather in some parts appears to have shifted some regularly March/April freight shipments into January and February. The index declined 1.3% from April 2022 from a 3.8% drop in March. Shipments fell by 2.4% in April when compared to 2022. Freight demand is near the bottom say some.

“With produce season arriving late this year and the freight market likely passing the peak of the destock, freight demand is near the bottom,” said Denoyer. “With inflation easing, improving real income trends will allow for a bit more holiday spending this year, when even less destocking will mean more freight volume.” Said Denoyer.

Denoyer wrapped up by saying, “The intersection of additional volume and tightening capacity underpins our forecast for a near-term bottom in spot truckload rates. We’ve been expecting the bottom roughly around this month since we introduced 2023 spot rate forecasts 16 months ago, and we still think RoadCheck this week will help usher in a new freight cycle.”

KPMG reported this on the 2023 supply chain…

Disruptions to supply chain operations are set to stay in 2023, whether they be …

- Existing or new geopolitical conflicts,

- Inflationary pressures

- Recessionary environment

- Climate change weather events

These can all impact access to goods and how they flow to their final destination, create port holdups, reduce container and ocean freight availability, and surge prices, among other concerns.

In 2023, amid these disruptions, there will likely be some key supply chain trends to manage. Response management to these can be a critical opportunity in the year ahead.

Nations will be skeptical about…

- Cross-border trade cooperation

- Cyber criminals will ramp up activity.

- Key material access turmoil.

- Manufacturing footprints will change shape.

- Retail and distribution supply chains are morphing rapidly.

- Supply chain technology investments will accelerate.

To help set yourself up for success in dealing with these supply chain trends in 2023, there are three overarching mechanisms you should have in place.

- Capability: A mature supply chain planning capability to always be a step ahead and ready to tackle supply chain risks and opportunities

- Agility: Making sure your supply chain is responsive and agile to manage the unexpected, and to deal with these threats and disruptions appropriately, efficiently, and profitably

- End-to-end forward-looking visibility: Having ‘control tower’ visibility on key real-time indicators; being able to maneuver your supply chain beyond your own business borders; and building real-time collaboration with your ecosystem of supply chain partners will likely be critical – all done using digital capabilities. The ultimate goal is to enhance collaboration across the supply chain eco-system.

Supply chain prospects seem quite positive this 2023, although not as strong pre-pandemic. Congestion in the shipping industry is getting more manageable and recovery is picking up pace. A return to supply chain normalcy is anticipated sometime in 2023. Make no mistake Canadian trucking was and still is up against the ropes. But a tag is around the corner.