Tax planning is an important component of financial planning. Tax planning involves activities and transactions that reduce or eliminate tax. Tax minimization means looking for legitimate strategies to reduce the individual’s tax liability that might otherwise be payable.

There are three basic income taxation structures: progressive, flat and surtax.

Canada uses progressive tax method. Individual pay federal and provincial level tax. A progressive tax rate structure increases the percentage of income tax applicable to each successive income bracket.

Flat structure: A flat income tax rate structure is one where everyone pays the same percentage of income tax, regardless of how much he/she earn

A surtax is an additional tax imposed in addition to the basic tax payable. From time to time, the federal and some provincial governments use surtaxes as a means by which to charge an additional income tax

Canadian tax resident: Factual resident and deemed resident individuals who ordinarily live in Canada are considered a resident of Canada and are referred to as factual residents. Factual residents are subject to tax in Canada on their worldwide income for the taxation year.

What is a factual resident?

You are a factual resident of Canada for tax purposes if you keep significant residential ties in Canada while living or travelling outside the country. The term factual resident means that, although you left Canada, you are still considered to be a resident of Canada for income tax purposes

What is a deemed resident?

Deemed Resident of Canada – If it has been determined by the CRA that you are not a factual resident, then you will be considered deemed. Liable for taxes on worldwide income throughout the year. A person is a deemed resident of Canada for tax purposes if they: Lived outside of Canada during the tax year. You stayed in Canada for 183 days or more (the 183-day rule) in the tax year, do not have significant residential ties with Canada, and are not considered a resident of another country under the terms of a tax treaty between Canada and that country.

Individual who are deemed to be a resident of Canada under the 183 days sojourning rule must pay tax on worldwide income earned throughout the entire taxation year.

Three federal departments are intimately involved in the workings of the Canadian tax system:

- Department of Finance: The government ministry responsible for drafting and revising the Income Tax Act.

- Canada Revenue Agency: CRA is responsible for administering the Income Tax Act and collecting the taxes taxpayers owe.

- Department of Justice: Legal disputes arise between a taxpayer and the CRA (often over the amount of money owed) the Department of Justice handles any litigation

The Canadian income tax system relies on self-assessment; taxpayers declare their income and take appropriate deductions and credits to determine their own income tax liability. Canada uses a self-assessment and self-reporting tax system

The concept of tax avoidance involves using tax planning to minimize the amount of income tax payable and doing so within the boundaries of Canadian tax laws.

Tax evasion occurs when taxpayers deliberately deceive the Canada Revenue Agency. knowingly not reporting income, omitting material information, or claiming false deductions and credits to which the taxpayer is not entitled. Tax evasion is illegal and can subject the taxpayer to both criminal and civil prosecution.

In very general terms, there are three types of taxpayers: individuals, corporations and trusts

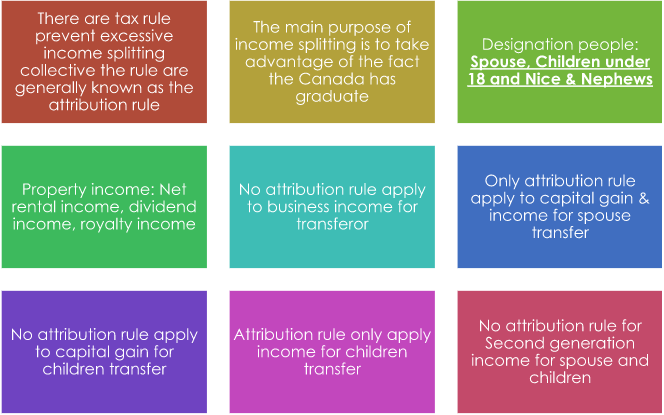

Attribution rule :Property that an individual transfers or lends, either directly or indirectly, to a person under age 18 and who is non-arm’s length to the individual or is a niece or nephew of the individual results in:

∙ Any income or loss from the property is attributed to the transferor

These rules apply when the individual is under age 18 for the entire year (i.e., has not turned age 18 by December 31). Income attribution ceases to apply in the year the minor turns age 18

Attribution ceases, on prior transfers to which it applied, when the transferor dies. There is no income attribution on testamentary transfers

Attribution does not apply to any income they earn on the amount that has been reinvested (second-generation income)

Property income versus business income :Income attribution rules apply to property income, which includes interest, dividends, rent and business income earned by a specified member of a partnership. A specified member of a partnership is a limited partner in a limited partnership. The income attribution rules do not apply to business income or losses. Therefore, it is important to determine the type of income when assessing whether the attribution rules apply.

RRSP Attribution rule :

Attribution rule: This rule is sometimes referred to as the three-year rule or the current plus two-year rule.

The attribution rules will not be applied in these situations:

∙ The year the contributing spouse dies

∙ The year an RRSP is terminated because of the death of the owner/annuitant

∙ If the contributing spouse or annuitant is non-resident at the time of the withdrawal

∙ After a divorce

∙ When spouses or common-law partners are living separate and apart from each other due to a relationship breakdown

∙ Spousal RRSP contribution: Attribution rule does not apply if the withdrawal take place at time when contributor is living separate and apart from the spouse due to breakdown of relationship.

The amount is a commutation payment that is transferred directly for a spouse or common-law partner to another RRSP, RRIF or (eligible) annuity that cannot be commuted for at least three year.

RRIF Attribution Rule :

If the RRIF annuitant’s spouse or common-law partner made contributions to any spousal RRSP in the current year or during the previous two years, any excess amount is subject to the attribution rules. The excess amount refers to income payments that exceed the minimum required by the plan.

Attribution on a spousal RRIF does not apply:

∙ To any payment received after the death of the contributing spouse

∙ If the contributing spouse or annuitant is non-resident at the time of the withdrawal

∙ When spouses are living separate and apart from each other due to a reason of the breakdown of the marriage (if spouses reunite, attribution rules will again become applicable)

∙ If the annuitant collapses the RRIF to purchase a qualifying annuity

Summary Attribution Rules :

Comments are closed